Do you have a 401(k) plan?

According to a 2004 survey, three out of four American workers do.

Chances are you own stock.

Chances are you have made money as the market has been hitting record highs.

WOO HOO!

From The New York Times:

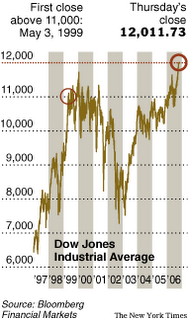

Less than three weeks after it set its first record high in more than six years, the Dow Jones industrial average closed above the 12,000-point mark for the first time this afternoon.

The achievement by the popular, though not comprehensive, barometer of the stock market indicates that investors are increasingly confident that the economy is poised to perform the rare feat of slowing without stalling. The Dow is up 12 percent so far this year.

The Standard & Poor’s 500-stock index, a broader measure of the market, has also done well and is up 9.5 percent for the year.

The Dow’s move above 12,000 came on modest gains for the day, with the industrial average rising 19.05 points, or 0.2 percent, to close at 12,011.73.

The day’s gains were just as modest elsewhere in the stock market. The S.&P. rose 1 point, or less than 0.1 percent, to 1,366.96, while the Nasdaq composite index rose 3.79 points, or 0.2 percent, to 2,340.94.

"It is the best of both worlds here," said Steven M. Rogé, a portfolio manager at the Rogé Partners Fund. "We have interest rates that are still below the long-term average, capital is still flowing freely and growth is strong but not excessive."

The current rally, which started in late July after an early summer swoon, has followed a well-worn pattern in which stocks do well in the last three months of midterm election years, analysts experts note. The one difference this time is that the stock market started moving up in the third quarter, which historically has proven to be a weak stretch.

It has to be killing the libs to report the good economic news.

In the immortal words of James Carville, "It's the economy, stupid."

If people vote their pocketbooks in this election, things look very good for Republicans.

There are some economic negatives to keep the libs from becoming too despondent.

[S]ome economists and bond investors do not share the stock market’s sanguine view. Atop their list of concerns is a softening housing market and its direct and indirect effect on the American economy.

If home sales continue to fall at current rates or faster, that decline will reduce employment in construction, mortgage lending and other related areas. Also, falling prices will make it harder for consumers to refinance and tap their homes for lines of credit for home improvement and other spending.

Other concerns include tensions in the Middle East and on the Korean peninsula. Those and other geopolitical crisis could easily reverse the two-month-long slide in oil and gasoline prices.

Do you get the feeling that the libs at The Times are praying for increased tensions in the Middle East and on the Korean peninsula?

I'm sure they're torn.

They like to see their 401(k)s swell, but on the other hand, they don't want to admit that the economy is strong for political reasons.

It's tough being a lib.

2 comments:

You should have just put the picture up......It says so much, it doesn't even need words.

But it's all just a Bush plot to "make the economy look good."

You should have put another graph right next to that of the DOW. A graph of gas prices going down.....That would show them!!!

Oops, that's a good thing, too:)

I don't think you should give Bush credit for the plot.

It's got Karl Rove's fingerprints all over it.

Post a Comment